Powered by Property Monitor

Market highlights

Capital values are consistently increasing.

Month-on-month (m-o-m) appreciation is nearly at 2%.

Prices are just 1.4% below the previous market peak.

Transaction volumes reached a record high in August.

Year-to-date sales have seen a remarkable 42% year-on-year increase.

Off-plan sales have reached their highest market share since the beginning of the pandemic.

Rental yields remain stable, in the mid-6% range.

The numders

+ 1.97% MoM change

+ 5.43% QoQ change

+ 18.57% YoY change

AED 1,216 average price per sq.ft.

12,134 monthly transactions

6.74% average gross rental yield

AED 209 million highest recorded sale

AED 100,000 lowest recorded sale

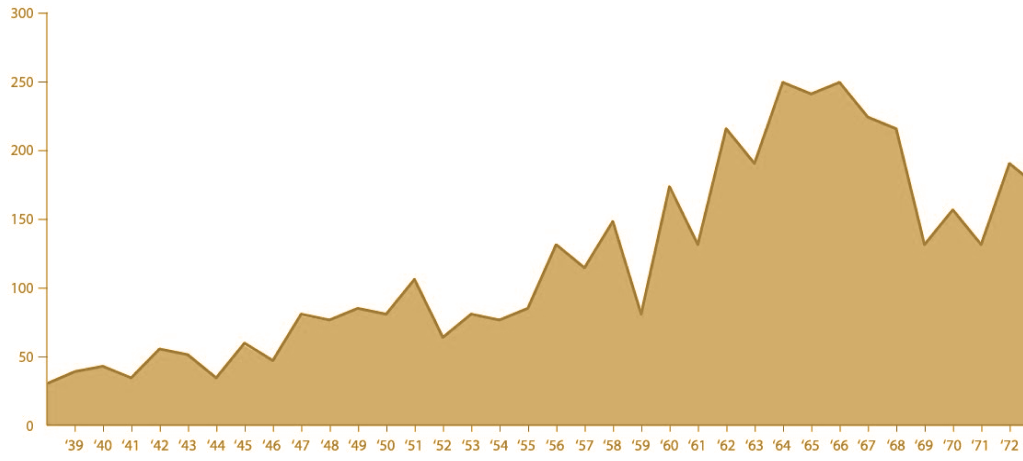

Dynamic price index

Dpi monthly sales overview

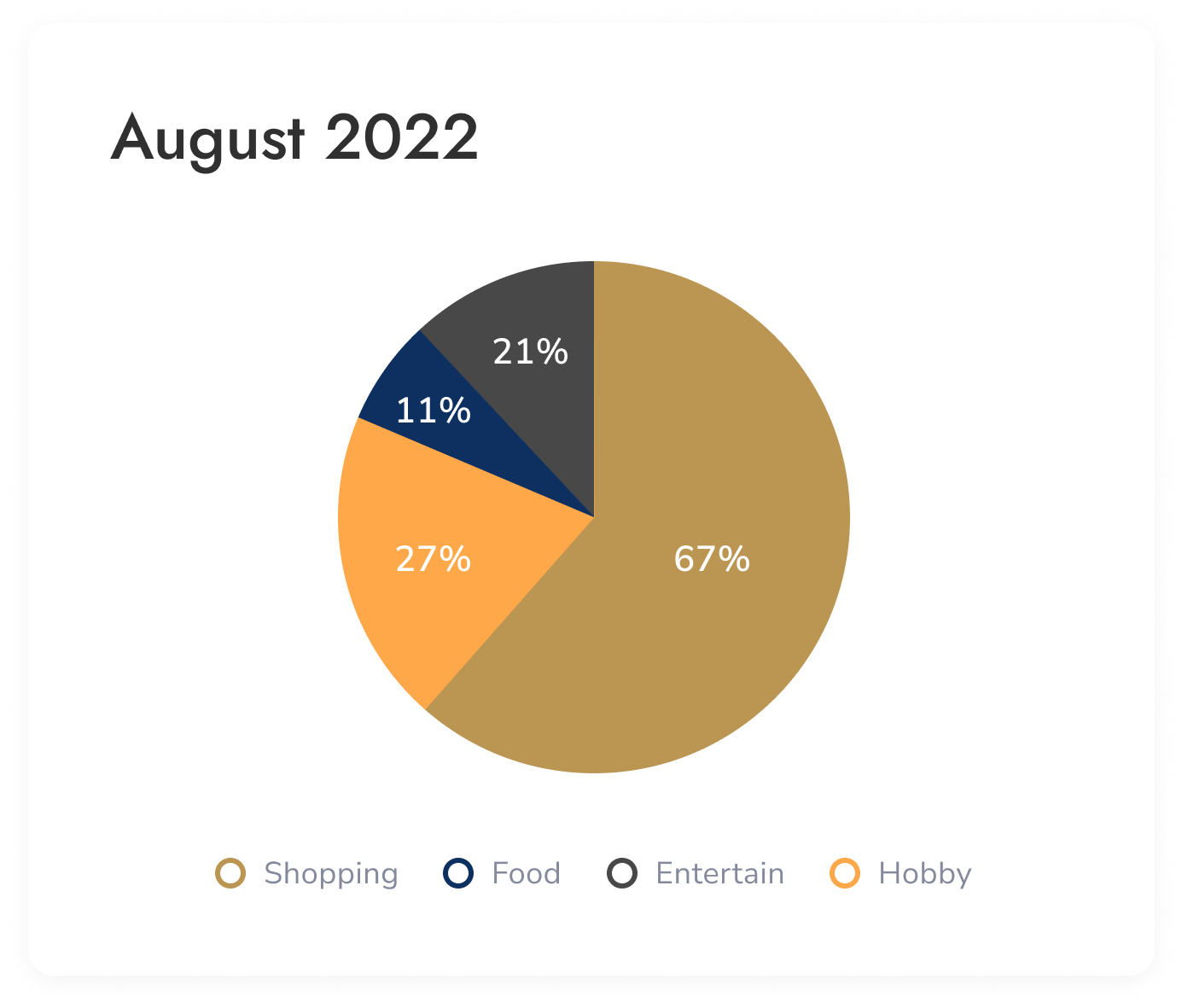

In the month of August, total sales transactions experienced a notable surge, rising by 8.1% compared to the previous month and reaching a record-breaking total of 12,134 sales. Residential transactions remained dominant, constituting a substantial 91.1% of the total sales volume, with 11,053 residential property sales. Meanwhile, the commercial sector was led by hotel apartments at 4.1%, office spaces at 2.1%, and land sales at 1.9%, as per the latest data provided by PM.

Year-to-date figures reveal a remarkable growth trend, with a total of 85,060 transactions, representing a substantial 41.9% increase compared to the previous year and an astonishing 125.4% surge compared to 2021. Monthly transaction rates in 2023 continue to outpace historical records, and there is a possibility of surpassing the annual record set in 2009. Projections suggest that sales may exceed 120,000 by year-end, and there is potential for surpassing the 2009 record as early as next month, providing an entire quarter for further growth.

Price ranges

The price range of AED 3 million to AED 5 million stood out as the top performer, experiencing a 4.5% growth and capturing a substantial market share of 16.7%. This remarkable growth can be attributed to the exceptional performance of two distinct projects: Rivana in The Valley, which achieved impressive sales in the high-end townhouse category at AED 984 per square foot, and Bayview at Emaar Beachfront, where sales of ultra-luxury apartments averaged AED 5,272 per square foot. In contrast, the price range of AED 10 million and above, which had reached an all-time high the previous month, saw a decline of 2.9%, dropping to 2.5%.

Pricing categories monthly analysis

When organizing the nine distinct pricing categories into three main groups, investors can observe that properties valued between AED 1 million and AED 3 million, which fall within the mid-tier, still dominate the market with a 47% share, showing a 3.6% month-over-month growth. The lower-priced categories, encompassing properties below AED 1 million, now constitute 29.3% of the market, indicating a 2.8% decrease from July. On the other hand, the upper echelon of the market experienced a 0.8% contraction following July’s gains, returning to represent a 23.7% market share.

Let us assist you in selling your home with a personalized approach.

Get in touch with our local specialists who can craft a thorough and customized strategy for your property, covering all aspects of marketing.